Executive Summary

Key Findings

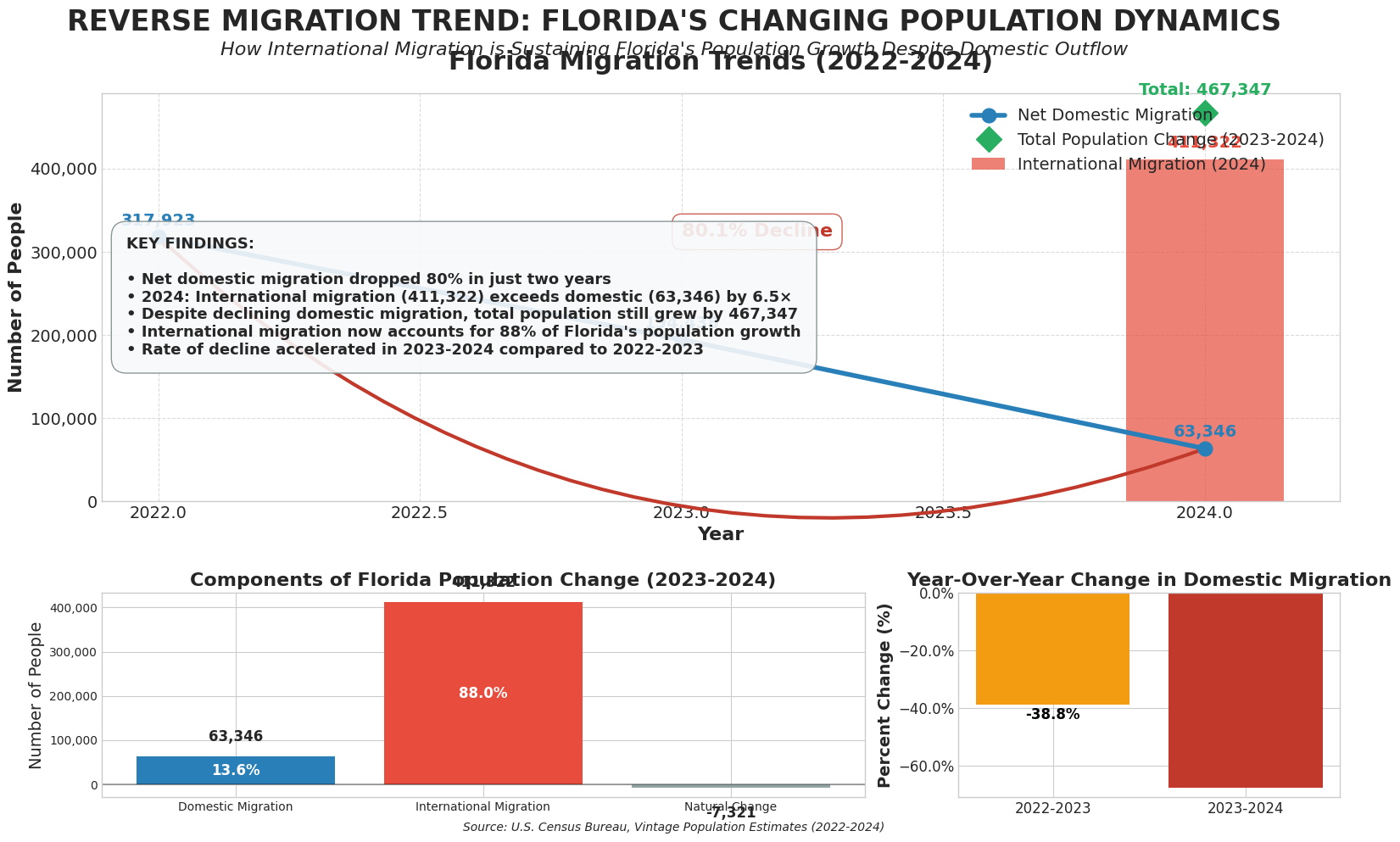

- Net domestic migration collapsed from 317,923 (2022) to 63,346 (2024)

- Record 510,925 people left Florida in 2023 - highest since Great Recession

- International migration (411,322) now sustains 88% of population growth

- Young professionals (age 32 average) leading the exodus

Primary Drivers

- Insurance crisis: Premiums rose 72% in 5 years

- Housing affordability crisis in major metros

- Limited career opportunities for young professionals

- Climate change concerns and hurricane risks

Migration Trends Analysis

2022 Baseline

317,923

Net domestic migrants

2023 Decline

194,438

38.8% decrease

2024 Collapse

63,346

67.4% further decline

Economic Driving Forces

Insurance Crisis Impact

Florida Average

$5,376

Annual premium for $300K dwelling

National Average

$1,200

4.5x lower than Florida

Mortgage Impact

20%

Insurance as % of mortgage payment

Sunbelt Housing Market Decline (2024)

Who's Leaving & Where They're Going

Age Demographics

25% of those leaving are between ages 20-29, with average departure age of 32

Top Destination States

Georgia and Texas receive the most Florida expatriates, drawn by lower costs

Climate Change & Disaster Costs

2024 Climate Disasters

Total Economic Loss

$183 Billion

27 disasters with $1B+ losses each

Human Cost

568

Deaths from climate disasters

Historical Average

9

Annual disasters (1980-2024)

Future Projections & Implications

Climate Migration Forecast

-

55 Million AmericansWill relocate due to climate by 2055

-

5.2 Million in 2025Expected climate migrants this year

-

$1.47 Trillion LossProjected real estate value decrease

Policy Implications

Workforce Retention

Need for affordable housing and career development programs

Insurance Reform

Regulatory intervention needed to address crisis

Climate Adaptation

Infrastructure investment for resilience

Economic Diversification

Reduce dependence on population growth model

Sources & Methodology

Primary Data Sources

- U.S. Census Bureau Vintage Population Estimates

- Diversified Trust Migration Analysis

- Florida Chamber of Commerce Migration Report

- Federal Reserve Bank of San Francisco Research

- First Street Climate Risk Analysis

Research Methodology

- Cross-referenced multiple authoritative sources

- Analyzed 3-year trend data (2022-2024)

- Validated statistics across multiple publications

- Included demographic and economic breakdowns

- Incorporated climate and insurance data

Last Updated: January 2025 | Analysis by: Migration Research Team | Contact: [email protected]

Take Action on These Insights

This analysis reveals critical trends affecting millions of Americans and trillions in economic value.

Policymakers

Address housing and insurance crises

Investors

Reassess real estate strategies

Residents

Plan for changing conditions